Expert Review

-

Easymoney

They'll shoot off SMS to your contacts, saying you owe them money.

Brace yourself for a barrage of nasty WhatsApp messages if you're just a day late.

Their repayment plans usually last between 6 to 14 days, making it a real struggle to pay up.

Expect overdue interest rates of 5% to 7% per day, pushing you deeper into debt.

Don't bother paying them back once they tarnish your name. They've already got what they wanted.

Since they're not licensed, they can't take legal action against you. Their only weapon is to smear your reputation.

Avoid borrowing from other loan apps to settle your debts; you'll only dig yourself into a deeper hole.

Use Truecaller to screen and block their calls, sparing yourself unnecessary stress.

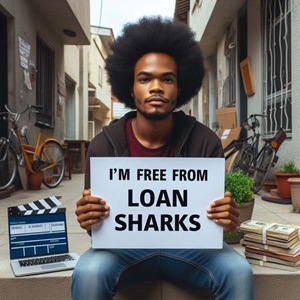

The best way to break free from loan sharks is to stop borrowing altogether.

Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to protect others from falling into the same trap.

-

Rocket Loan(Nigeria Loan)

Online loan apps may seem like a quick fix when you're in need of cash, but they often come with hidden dangers and risks that can harm your financial and personal well-being. Here are 10 crucial tips to keep in mind when dealing with these apps:

1. Only Download Loan Apps from Official Sources

To protect yourself from malicious apps, only download loan applications from trusted sources like the Google Play Store or Apple App Store. Avoid third-party websites, as apps from unofficial sources often misuse personal information, leading to cyberbullying or privacy breaches. Some rogue apps may even access your contacts without permission.

2. Be Ready for Harassment if You Miss Payments

Loan apps are notorious for aggressive tactics. If you're even a day late with repayment, you could receive numerous threatening and unpleasant messages, particularly on platforms like WhatsApp. If this happens, don't hesitate to block the sender. Protecting your mental peace is essential during these situations.

3. Watch Out for Short Repayment Periods

Most loan apps offer very short repayment windows, typically between 6 and 14 days. These brief periods make it challenging for borrowers to repay in time, trapping them in a cycle of debt. The pressure to meet such tight deadlines often leads to further borrowing from other loan apps, creating a downward spiral of financial stress.

4. Prepare for High Overdue Interest Rates

If you miss a payment deadline, expect the overdue interest rates to be punishing—often ranging between 5% and 7% daily. This means that even a small overdue amount can snowball into a significant debt, making it even harder to get back on track.

5. Reputation Damage as Leverage

Loan apps often resort to reputation damage as a form of leverage. They may send embarrassing or threatening messages to your contacts, tarnishing your image. Unfortunately, once your reputation has been damaged, some borrowers decide not to repay the loan since the harm has already been done. If you face this, creating a legal disclaimer or publicly denying false claims could help mitigate the damage.

6. Avoid Borrowing from Other Loan Apps to Repay Existing Debts

It's tempting to borrow from another loan app to repay an existing loan, but this only worsens your financial situation. You could end up in a deeper cycle of debt, making it nearly impossible to break free. Focus on finding more sustainable solutions to repay your debts.

7. Use Truecaller to Block Harassing Calls

If you're receiving harassing calls from loan apps, Truecaller is an effective tool to help you identify and block such numbers. This can shield you from unwanted stress and give you some breathing room to focus on your financial recovery.

8. Break the Borrowing Cycle

The best way to free yourself from the clutches of predatory loan apps is to stop borrowing altogether. While it might seem difficult, breaking the cycle of dependency on these apps is crucial to gaining control over your finances.

9. Report and Block Harassers

If loan apps resort to harassing you on platforms like WhatsApp, report and block them. You can also report abusive apps to the Google Play Store or Apple App Store to prevent others from becoming victims of the same practices.

10. Avoid Loan Apps Altogether

In many cases, the best advice is to avoid loan apps entirely. They are often designed to trap you in a cycle of debt, exploit your financial difficulties, and misuse your personal information. Consider more secure and legitimate financial alternatives such as credit unions, community banks, or trusted lending platforms.

-

Lendsafe

Lendsafe is a notorious loan app scammers. asking if Loan apps defame is not relevant, your goal is to know how they operate

Go through the link below

Check this, How to know if Loan Apps will Defame you or not https://loansharkreview.com/TrainingDetails/5

To check for iPhone Kindly check you privacy and settings if the contact permission is either Full, Private, or None

Also, what you need to know about clearing your Contacts from Loan app Databases is it true or not?

https://loansharkreview.com/TrainingDetails/14

How how loan app agents are scamming people on Facebook groups

https://loansharkreview.com/TrainingDetails/6

To handle any loan apps

- If you download any loan apps OUTDISE Play Store or App Store Generate your own Disclaimer to counter Loan apps and send it to all your contacts. get a sample here https://loansharkreview.com/GenerateDisclaimer

- Put ALL your social media accounts to private

- Install Truecaller and block all spam calls and related spam calls. If it is not working effectively, upgrade to premium version

- Start the fight by giving them wotowoto they will flee from you. Give loan app agents a taste of their own medicine https://www.youtube.com/watch?v=m8RSJsLbWpM

- Report Loan Apps to the Nigeria Police Force National Cybercrime Center https://www.youtube.com/watch?v=Nj1VPsXape8

You'll be free in under 1 week

Step by step guide to break free from loan apps

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.