Expert Review

-

Nicenaira

- They’ll send SMS blasts to your contacts, claiming you owe them money.

- Be ready for a flood of nasty WhatsApp messages if you’re even a day late.

- Their repayment windows are ridiculously short—just 6 to 14 days—making it nearly impossible to repay on time.

- Expect daily overdue interest rates between 5% and 7%, pushing you deeper into debt.

- Once they’ve trashed your reputation, paying them back is pointless—they’ve already hit their goal.

- Since they’re unlicensed, they can’t take legal action. Ruining your name is their only weapon.

- Don’t borrow from other loan apps to clear your debt—it’ll only dig you into a deeper hole.

- Use Truecaller to block their calls and protect your peace of mind.

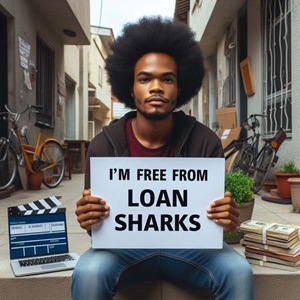

- The best way to beat loan sharks? Stop borrowing altogether.

- Block them on WhatsApp and report them to both WhatsApp and Google Play Store to stop others from falling into their trap.

-

Okash

- Okash is a legit and authorized loan app, so you're in safe hands.

- They won't tarnish your reputation or spread rumors about you.

- If you default on your payments, they'll take the necessary steps and report the matter to the appropriate authorities.

- While their overdue interest rates are fair, you have the option to skip paying them back once you've settled the principal and initial interest.

- Avoid borrowing from other loan apps to settle your debt with Okash. Instead, pay them back when you have the funds available. You can even stretch out your payments over several months, just make sure to honor your commitment.

- Consider installing Truecaller on your phone to identify and block their calls if you'd rather not engage with them.

-

Plenty Cash - safe & Instant loan

1. Your contacts might receive SMS notifications indicating that you owe money to Plenty Cash.

2. If you're overdue by just one day, you might start receiving derogatory messages via WhatsApp from the loan provider.

3. Repayment plans typically range from 6 to 14 days, which can prove challenging for many borrowers.

4. The interest rates on overdue payments can vary from 2% to 7% per day, potentially increasing your debt significantly.

5. It's advisable not to repay them if they resort to defaming you. Remember, they've already received their money, and defamation is their only means of recourse.

6. Since these loan apps are unlicensed, their only means of enforcement is through defamation.

7. Borrowing from another loan app to settle debts with Plenty Cash could potentially worsen your financial situation and lead to bankruptcy.

8. Installing Truecaller on your mobile phone can help you identify and block calls from Plenty Cash and similar entities.

9. The best solution to break free from loan sharks like Plenty Cash is to stop borrowing altogether.

10. Take proactive steps to block them on WhatsApp and report their activities directly on WhatsApp and Google Play Store.

11. Remember, you have options beyond borrowing from these loan apps. Prioritize your financial well-being and integrity.

Step by step guide to break free from loan apps

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.