Expert Review

-

Snappycredit-momogo

They'll shoot off SMS to your contacts, saying you owe them money.

Brace yourself for a barrage of nasty WhatsApp messages if you're just a day late.

Their repayment plans usually last between 6 to 14 days, making it a real struggle to pay up.

Expect overdue interest rates of 5% to 7% per day, pushing you deeper into debt.

Don't bother paying them back once they tarnish your name. They've already got what they wanted.

Since they're not licensed, they can't take legal action against you. Their only weapon is to smear your reputation.

Avoid borrowing from other loan apps to settle your debts; you'll only dig yourself into a deeper hole.

Use Truecaller to screen and block their calls, sparing yourself unnecessary stress.

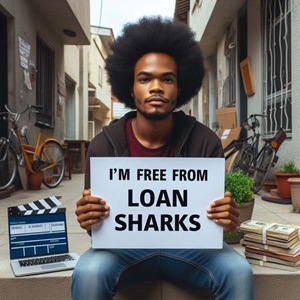

The best way to break free from loan sharks is to stop borrowing altogether.

Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to protect others from falling into the same trap.

-

SmartNaira

While loan apps may appear to provide a quick fix for financial issues, they often carry considerable risks. Here are ten essential tips to consider when using these online lending platforms:

- Expect Intense Communication for Late Payments

Even a single day of delay in your repayment could result in aggressive messages, particularly on messaging apps like WhatsApp. If you encounter such harassment, don’t hesitate to block the sender for your own peace of mind. - Refrain from Borrowing from Multiple Sources

Turning to other loan apps to cover existing debts can ensnare you in a vicious borrowing cycle. This strategy typically exacerbates your financial difficulties rather than alleviating them. - Be Cautious of High Penalty Interest Rates

Late payments can trigger daily interest penalties ranging from 5% to 7%. These rates can rapidly inflate your debt, making it even harder to repay. - Download Apps Only from Reputable Sources

Always download loan apps from reliable platforms like the Google Play Store. Obtaining apps from unofficial sources can jeopardize your personal information and expose you to fraud or harassment. - Consider Alternatives to Loan Apps

Many loan apps are designed to entrap users in cycles of debt, often jeopardizing their financial well-being and privacy. It might be wiser to seek out safer, more reliable financial alternatives. - Be Mindful of Short Repayment Terms

Some loan apps may impose repayment periods as brief as 6 to 14 days, complicating timely payments and increasing your risk of falling into further debt. - Safeguard Your Personal Reputation

In certain instances, loan apps may contact your friends or family to publicly shame you. While the damage can be disheartening, avoiding the loan is a more prudent choice than succumbing to pressure. - Cease Borrowing to Regain Control

To break free from predatory lenders, stopping further borrowing is crucial. Though it may be a challenging step, it’s essential for regaining control of your financial situation. - Utilize Call Management Applications like Truecaller

Truecaller can effectively block unwanted calls from loan apps, helping to alleviate stress and minimize harassment from lenders. - Report and Block Threatening Messages

If you receive menacing messages, especially through platforms like WhatsApp, take prompt action by blocking the sender and reporting them to WhatsApp and the Google Play Store. This helps safeguard others from similar harassment.

-

Nicenaira

- They’ll send SMS blasts to your contacts, claiming you owe them money.

- Be ready for a flood of nasty WhatsApp messages if you’re even a day late.

- Their repayment windows are ridiculously short—just 6 to 14 days—making it nearly impossible to repay on time.

- Expect daily overdue interest rates between 5% and 7%, pushing you deeper into debt.

- Once they’ve trashed your reputation, paying them back is pointless—they’ve already hit their goal.

- Since they’re unlicensed, they can’t take legal action. Ruining your name is their only weapon.

- Don’t borrow from other loan apps to clear your debt—it’ll only dig you into a deeper hole.

- Use Truecaller to block their calls and protect your peace of mind.

- The best way to beat loan sharks? Stop borrowing altogether.

- Block them on WhatsApp and report them to both WhatsApp and Google Play Store to stop others from falling into their trap.

-

Tloan

Tloan, These guys might seem like a quick fix, but trust me, they can turn into a major headache. Here's the lowdown on why you should steer clear:

1. Shameful Tactics: Forget polite reminders. These apps blast your contacts, painting you as a defaulter even after a day's delay. They might even spam your WhatsApp with nasty messages, tarnishing your reputation in a heartbeat.

2. Crushing Deadlines: They offer loans with super-short repayment periods, like 6-14 days. It's like setting you up to fail, leading to...

3. Debt Spiral: Their insane interest rates (think 2% to 7% per DAY!) trap you in a cycle of debt. Borrowing from another app to pay them off? Bad idea. You'll just end up deeper in their clutches.

4. Empty Threats: Don't let their bullying tactics scare you. These apps often operate outside the law, so their threats are mostly just noise. They can't really do anything to you, except try to shame you.

5. Breaking Free: Here's the key: stop borrowing. It's tough, but it's the only way to escape their grip. Remember, you survived before they came along. You can do it again.

Here's your action plan:

- Install Truecaller: Identify and block their calls.

- Block them on WhatsApp: Cut off communication.

- Report them: Flag them on WhatsApp and the app store.

- Seek help: Talk to trusted friends or family, or consider professional financial advice.

Remember, your dignity and peace of mind are worth more than any quick loan. Don't let these loan sharks drag you down. Take back control and build a brighter future, one step at a time.

-

Silk loan

When using Silk Loan App, it’s crucial to be aware of the following potential risks and practices that may affect your financial well-being:

1. Broadcasting Your Debt

Silk Loan App may notify your contacts via SMS regarding your outstanding debt. This tactic aims to exert pressure on you by involving your personal network.

2. Harassment on WhatsApp

If you miss a payment, be prepared for aggressive and relentless messages on WhatsApp. Even a single day of delay can trigger a wave of distressing communications.

3. Tight Repayment Window

The repayment periods offered by Silk Loan App are typically very short, often ranging from just 6 to 14 days. This limited timeframe can create significant pressure and make it challenging for borrowers to meet their obligations.

4. High Interest on Overdue Payments

If you fail to repay on time, be cautious of their exorbitant overdue interest rates, which can escalate rapidly from 1% to 5% per day. This can quickly deepen your financial burden and lead to unmanageable debt.

5. Reputation Over Debt

Once Silk Loan App begins defaming you, simply paying back the loan may not restore your reputation. Their primary objective is to tarnish your name, which they accomplish through public shaming tactics.

6. Unlicensed and Defamatory Tactics

Silk Loan App often operates without proper licensing and resorts to defamation as a means of coercing repayment. This unscrupulous behavior can leave borrowers feeling vulnerable and powerless.

7. Avoid Borrowing from Other Loan Apps

Steer clear of the trap of taking out additional loans from other apps to repay Silk Loan App. This strategy often leads to a vicious cycle of debt, making your financial situation even worse.

8. Block Their Calls

Utilize call management apps like Truecaller to identify and block persistent calls from Silk Loan App. This can significantly reduce the stress of constant harassment.

9. Break Free from the Cycle

The most effective way to regain control over your finances is to cease borrowing from Silk Loan App entirely. While it may be difficult, breaking free from their grip is essential for your financial health.

10. Take Action

Don't hesitate to block them on WhatsApp, and report any abusive behavior to WhatsApp and the Google Play Store. Protecting yourself from their unscrupulous tactics is vital.

11. Stay in Control

Remember that you managed your finances effectively before Silk Loan App entered the picture. Do not allow their manipulative practices to harm your reputation or drain your resources.

By staying informed and proactive, you can safeguard yourself against the negative consequences of using Silk Loan App and maintain control over your financial future.

-

Ultra naira

Loan Agreements in Nigeria: Understanding Your Rights

Under Nigerian law, loan agreements can be deemed invalid or unenforceable in certain situations. These include:

- Unlicensed Money Lenders: Operating without a valid license from the Central Bank of Nigeria (CBN) or relevant state authorities can make contracts unenforceable.

- Excessive Interest Rates or Hidden Fees: Contracts with unconscionable terms may be unenforceable under consumer protection laws, as regulated by the CBN.

- Fraud, Misrepresentation, or Coercion: Contracts obtained through deception, misleading statements, or threats can be voidable.

- Breach of Privacy & Harassment: Loan apps that invade borrowers' privacy or engage in harassment may have contracts that can be challenged as invalid under the Nigerian Data Protection Regulation (NDPR) and FCCPC guidelines.

- Lack of Written Agreement: Loan agreements exceeding ₦20,000 (varies by state) require a written contract signed by both parties to be enforceable.

- Violation of Loan Tenure & Repayment Rules: Contracts that violate CBN guidelines on microfinance lending may be challenged.

- Duress or Undue Influence: Contracts signed under threats, blackmail, or undue influence are invalid under Nigerian Contract Law.

- Lending to Minors: Loan contracts with individuals under 18 years old are automatically void.

Understanding these points can help borrowers navigate loan agreements and protect their rights.

-

TCredit

1. They will send SMS messages to your contacts, claiming that you owe them money.

2. Prepare yourself for an onslaught of unpleasant WhatsApp messages if you are even a day late.

3. Their repayment schedules typically range from 6 to 14 days, making it extremely challenging to settle your debts.

4. Anticipate daily overdue interest rates ranging from 5% to 7%, pushing you further into debt.

5. Once they tarnish your reputation, there is no need to repay them. They have already achieved their goal.

6. Since they lack a license, they are unable to pursue legal action against you. Their sole tactic is to damage your reputation.

7. Avoid borrowing from other loan apps to clear your debts; this will only worsen your situation.

8. Utilize Truecaller to screen and block their calls, sparing yourself unnecessary stress.

9. The most effective way to break free from loan sharks is to cease borrowing altogether.

10. Block them on WhatsApp and report them directly to WhatsApp and Google Play Store to prevent others from falling victim to the same scheme.

Step by step guide to break free from loan apps

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.