Expert Review

-

9Credit

Let's address 9Credit and its operations. To begin, it's essential to understand that regardless of the loan amount provided, repayment must occur within a maximum period of 7 days, as their repayment tenure does not exceed this timeframe.

Moreover, instead of directly contacting you about outstanding debts, 9Credit opts to send SMS notifications to your contacts, informing them of your indebtedness. Additionally, if you fail to meet repayment deadlines, they resort to sending disparaging messages via WhatsApp to your contacts, starting as soon as one day after the due date.

Typically, their repayment plans span from 6 to 14 days, presenting challenges for borrowers in meeting their financial obligations. Adding to the burden is the high overdue interest rate, ranging between 5% to 7% per day, which can quickly escalate your debt.

It's important to refrain from repaying them once they resort to defaming you, as this only serves to enrich them. Despite being unlicensed loan apps, 9Credit and similar services lack legal authority. Their primary recourse is to tarnish your reputation.

Attempting to borrow from other loan apps to repay 9Credit only worsens your financial situation. Given their multiple apps available on mobile app stores, borrowing from another source may inadvertently lead to borrowing from them again, plunging you into further debt.

Consider installing Truecaller on your mobile device to identify and block their calls, providing a measure of protection. Additionally, blocking them on WhatsApp and reporting their activities directly on WhatsApp and Google Play Store can serve as deterrents.

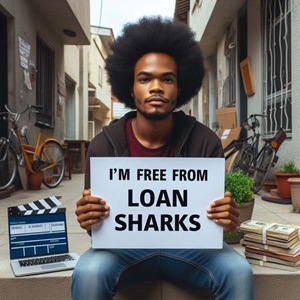

Ultimately, the most effective solution to break free from the grip of loan sharks like 9Credit is to cease borrowing altogether. By taking control of your finances and avoiding further indebtedness, you can safeguard your financial well-being in the long run.

-

Nairacup

We will review the apps within the next 48 hours and provide detailed information and also do our background checks

-

SomeMoni

Let's chat about SomeMoni. Here's what you need to know:

1. They're not shy about letting your contacts know you owe them cash, hitting them up with SMS messages.

2. Brace yourself for a barrage of not-so-nice messages on WhatsApp if you're even a day late with your payment.

3. Their repayment plans usually give you a tight window, ranging from 6 to 14 days, which can be a real challenge to meet.

4. Watch out for their sky-high overdue interest rates, ranging from 1% to a hefty 5% per day. That'll only bury you deeper in debt.

5. Don't cave and pay up if they start tarnishing your name. They're just after their money, and once they've defamed you, they've got what they wanted.

6. They may not have a license, but their weapon of choice is defamation. Pretty low, huh?

7. Whatever you do, don't try borrowing from another loan app to settle your debts with them. It's a trap! You'll just end up in more hot water.

8. Thinking about screening their calls? Consider installing Truecaller on your phone to see who's ringing before you answer. That way, you can dodge their calls if you're not in the mood to chat.

9. The best way to shake off loan sharks is to kick the borrowing habit altogether.

10. If they're causing trouble, don't hesitate to block them on WhatsApp and report their shady practices straight to WhatsApp and the Google Play Store.

11. Remember, you were doing just fine before they came along. Don't let them mess with your reputation or your wallet.

Step by step guide to break free from loan apps

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.