Expert Review

-

Rocket Loan

No Public Shaming, But Gentle Nudges: They won't blast your contacts like some loan sharks, but expect friendly (or not-so-friendly) reminders to pay up. Remember, open communication is key, so talk to them about your repayment plan if needed.

Overdue Fees: Pay or Don't, It's Up to You: Like most loan apps, they charge extra for late payments. But here's the twist: once you pay the original loan and regular interest, you don't have to pay the late fees. Sounds good, right? Just remember, paying them all off helps your credit score.

Block Annoying Calls (But Maybe Don't): If their reminders feel like harassment, use Truecaller to block their numbers. However, blocking completely might shut off potential repayment solutions.

Say NO to the Debt Spiral: This one's crucial! Only use Rocket Loan if you're 100% sure you can repay on time. Borrowing from another app to pay them is a recipe for disaster!

Truecaller for Selective Blocking: You can use Truecaller to identify and block their calls if needed. But remember, clear communication is often better than shutting them out completely.

Your Options Are Wide Open: Don't feel pressured to borrow if you're not comfortable. Explore other solutions like budgeting, finding extra income, or seeking financial advice before jumping into any loan, even one with "secure savings" in the name.

Your Well-being is Top Priority: Remember, your financial peace of mind and good credit score are crucial. Use Rocket Loan responsibly and only if you understand their terms, interest rates, and repayment options. It's always best to borrow what you can truly afford to pay back.

In the end, there's no magic app for instant wealth. Be cautious, make informed decisions, and remember, you have options beyond loan apps!

-

Rocket loan plus

Legality of the Agreement

Under Nigerian Civil Law, particularly in the context of money lending and microfinance banking, a contract may be considered invalid, unenforceable, or void in the following situations:

1. Illegal or Unlicensed Money Lender

According to the Money Lenders Act, any money lender operating without a valid license from the relevant state authorities or the Central Bank of Nigeria (CBN) is illegal, making contracts with them unenforceable

2. Unconscionable or Exploitative Terms

Contracts with excessive interest rates or hidden fees may be deemed unconscionable and unenforceable under consumer protection laws.

The Central Bank of Nigeria (CBN) caps interest rates for microfinance banks and regulates fair lending practices.

3. Fraud, Misrepresentation, or Coercion

A contract is voidable if the lender used deception, misleading statements, or threats to force a borrower into signing.

Section 19 of the Money Lenders Act states that fraudulent or deceptive lending practices can make a loan agreement unenforceable.

4. Breach of Privacy & Harassment by Loan Apps

Loan apps that invade borrowers’ privacy by sending defamatory messages to contacts violate the Nigerian Data Protection Regulation (NDPR).

FCCPC has declared harassment by loan apps as illegal, and contracts based on such practices can be challenged as invalid.

5. Absence of a Proper Written Agreement

Under the Money Lenders Act, any loan exceeding ₦20,000 (varies by state) must have a written agreement signed by both parties.

If there is no signed agreement, the lender may not be able to enforce repayment legally.

6. Violation of Loan Tenure & Repayment Rules

CBN guidelines on microfinance lending specify minimum and maximum repayment tenures.

A contract that violates these guidelines may be challenged.

7. Duress or Undue Influence

If a borrower is forced to sign under threats, blackmail, or undue influence, the contract is invalid under Section 20 of the Contract Law of Nigeria.

8. Lending to a Minor

A loan contract with anyone under 18 years old is automatically void under the Nigerian Contract Law.

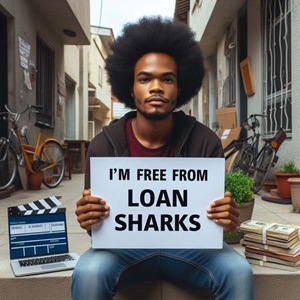

Step by step guide to break free from loan apps

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.