Expert Review

-

PalmCash

Let's delve into PalmCash and its practices. Firstly, it's important to note that this service may resort to sending SMS messages to your contacts if you owe them money. Additionally, they may escalate by sending derogatory messages via WhatsApp if your payment is just one day overdue.

Typically, PalmCash offers repayment plans spanning from 6 to 14 days, which can be challenging to fulfill. Moreover, their overdue interest rates range from 5% to 7% per day, potentially leading to a cycle of increasing debt.

It's crucial to understand that repaying them after they defame you may not solve the issue, as they profit from tarnishing your reputation. These loan apps lack proper licensing and rely solely on defamatory tactics to enforce repayment.

Borrowing from other loan apps to settle your debt with PalmCash can exacerbate your financial troubles, as you may find yourself trapped in a spiral of debt across multiple platforms.

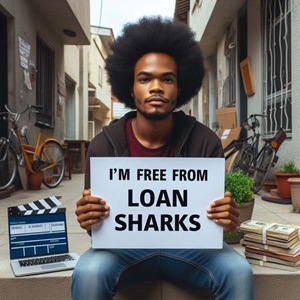

To mitigate their impact, consider installing Truecaller to identify their calls and block their contacts. Furthermore, the most effective solution to break free from loan sharks like PalmCash is to cease borrowing altogether.

Taking proactive measures such as blocking them on WhatsApp and reporting their activities on WhatsApp and Google Play Store directly can help protect yourself and others from falling victim to their practices.

-

Palmcredit

Palmcredit is a reputable lending platform that prioritizes borrower satisfaction and provides valuable financial assistance. Here are some essential aspects to consider when engaging with Palmcredit:

After 30 days you'll stop receiving calls and messages from them

Respectful Repayment Approach: Palmcredit upholds a respectful approach towards repayment. They do not engage in defamatory practices if borrowers opt to repay gradually until the full amount is settled. This allows borrowers to manage their repayment schedule at their own pace without facing any negative consequences from the platform.

Interest Payment Guidelines: Borrowers are advised not to pay overdue interest after clearing the normal interest and capital amount. Following this guideline helps borrowers avoid unnecessary financial strain and ensures a smoother repayment process.

Communication Management: In cases where borrowers experience persistent communication from Palmcredit via calls or WhatsApp messages, it is advisable to block their contacts and WhatsApp numbers. This proactive step empowers borrowers to maintain their peace of mind and minimize potential disturbances.

Avoid Borrowing to Repay: It is strongly discouraged to borrow from another loan app to settle dues with Palmcredit. Engaging in such practices may lead to a cycle of debt and financial instability, exacerbating existing financial challenges.

Utilize Truecaller for Blocking: Installing Truecaller on a mobile phone can be beneficial for borrowers looking to block unwanted calls from Palmcredit. Truecaller allows users to identify and block spam calls, including those from lenders, thereby providing an additional layer of control over communication channels.

By adhering to these guidelines and leveraging Palmcredit's transparent and borrower-centric approach, individuals can effectively manage their financial obligations and maintain a positive relationship with the platform.

-

Palmpay

When considering loans from PalmPay, it’s crucial to be aware of the following practices:

1. Broadcasting Your Debt

PalmPay may not hesitate to inform your contacts via SMS about your outstanding debt. This tactic is aimed at putting pressure on you to repay quickly.

2. Harassment on WhatsApp

If you're even a day late on repayment, you can expect to receive a barrage of aggressive messages through WhatsApp. This can be overwhelming and adds stress to an already difficult situation.

3. Tight Repayment Window

PalmPay typically has short repayment periods ranging from 6 to 14 days, making it challenging to meet deadlines and manage your finances effectively.

4. High Interest on Overdue Payments

Overdue payments can incur high interest rates that escalate quickly, ranging from 1% to 5% per day. This can lead to a rapid accumulation of debt, making it difficult to regain control of your financial situation.

5. Reputation Over Debt

Once PalmPay starts defaming you, simply repaying the debt may not restore your reputation. Their actions can tarnish your name long after the debt is settled.

6. Unlicensed and Defamatory Tactics

Even if PalmPay operates without proper licensing, their primary strategy often relies on defamation—a cheap and unethical way to compel repayment.

7. Avoid Borrowing from Other Loan Apps

Refrain from borrowing from other loan apps to repay PalmPay. This can trap you in a vicious cycle of debt that becomes increasingly difficult to escape.

8. Block Their Calls

Utilize apps like Truecaller to identify and block persistent calls from PalmPay. This can help reduce stress and interruptions in your daily life.

9. Break Free

The most effective solution is to stop borrowing from PalmPay entirely. Free yourself from their cycle of debt and regain control over your finances.

10. Take Action

If PalmPay engages in unscrupulous behavior, don’t hesitate to block them on WhatsApp and report their actions to WhatsApp and the Google Play Store.

11. Stay in Control

Remember, you were managing your finances just fine before PalmPay entered the picture. Don't let their tactics damage your reputation or drain your finances. Take charge of your financial future today!

Step by step guide to break free from loan apps

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.