Expert Review

-

Frimoni

Protect Yourself When Dealing with Unregistered Loan Apps: A Guide for Frimoni Users

If you're managing loans from unregulated loan providers like IMoney, it's essential to understand certain key aspects of repayment and how to safeguard yourself. Here’s what you need to know when dealing with such platforms:

1. Unregistered Loan Apps

IMoney is not a registered loan app, meaning it does not adhere to the legal guidelines set by Nigerian financial authorities. This lack of regulation can lead to unethical practices, so proceed with caution if you're involved with such services.

2. Dealing with Derogatory Messages to Your Contacts

If IMoney has sent offensive or embarrassing messages to your contacts in an attempt to pressure you into repayment, do not panic. While this tactic is harmful, it’s a strategy used to coerce borrowers. You are not legally obligated to repay under duress. If they persist, calmly inform them that you’re ready to address the matter in court, which often dissuades further harassment.

3. Defamation and Reputational Harm

If your reputation has already been damaged by IMoney through defamatory messages, repaying them will not necessarily undo the harm caused. Once your reputation is affected, the damage is done, and paying them back may not restore it. Focus on protecting yourself from further harassment instead.

4. Install TrueCaller to Block Spam Calls

Install the TrueCaller app on your phone to help identify and block spam calls, including any harassing calls from IMoney. This app provides an extra layer of protection against unwanted contact.

5. Block Auto Debit from Your Bank Account

To prevent IMoney from automatically withdrawing money from your bank account, it’s essential to block your bank card. Visit your bank and request a new card to ensure they can't access your funds through auto-debit.

6. Block and Report on WhatsApp

If IMoney contacts you via WhatsApp, block their number to stop receiving their messages. Additionally, report their number to WhatsApp to alert the platform about their behavior, which may lead to their account being flagged or suspended.

7. Report the App to Google Play or iOS App Store

If IMoney is listed on the Google Play Store or iOS App Store, report the app to the platform. This not only helps alert other users to their unethical practices but may also result in the removal of the app from these stores, protecting future borrowers.

Take Action to Protect Yourself

By following these steps, you can safeguard yourself from further harassment and protect your finances. Whether it's blocking calls, reporting the app, or preventing unauthorized withdrawals, you have control over how to respond to unethical loan providers like IMoney.

Remember, Frimoni provides a safe and transparent loan process, so you can avoid these pitfalls with our reliable service. Always choose trusted, registered loan apps to protect your peace of mind.

-

Branch

Branch Loan App is a safe lending platform approved by the Federal government. They prioritize customer privacy and won't contact your phone contacts or guarantors. However, it's crucial to repay overdue loans promptly. Branch Loan App is a registered Microfinance Bank and can report unpaid debts to credit bureaus, which may harm your credit score. This could affect your ability to obtain loans from other financial institutions such as Banks in Nigeria, and rebuilding your credit score may take up to 6 months, even after repayment.

If you have outstanding loans with Branch Loan App, consider repaying them at a comfortable pace. You can spread your payments over several months, such as ₦2,000 per month, depending on your outstanding balance. Avoid rushing to repay all at once to avoid undue pressure.

Always repay Branch Loan App in installments. Avoid borrowing from other loan apps to settle your debts, as this may lead to further financial difficulties.

-

EaseMoni

Let's dive into EaseMoni and what you need to know:

1. They're legit loan apps, fully registered and approved.

2. You won't find them spreading rumors or tarnishing your name.

3. If you don't hold up your end of the deal, they'll escalate the matter to the right authorities.

4. Their overdue interest rates are fair, but once you've paid off the principal and initial interest, you can choose not to pay the overdue charges.

5. Avoid the temptation to borrow from other loan apps to settle your debts. Instead, pay them back when you have the funds, even if it takes a few months.

6. Use Truecaller on your phone to screen calls from them, giving you the option to dodge their calls if you're not in the mood to chat.

-

Flexicash palmpay

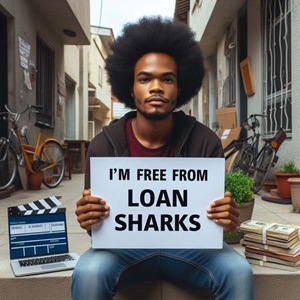

We will review the apps within the next 48 hours and provide detailed information and also do our background checks10 Commandments for Dealing with Loan Sharks

1. Ignore Harassing Messages: If loan sharks have already contacted your friends or family, don't worry. You don't owe them anything more. Move forward and focus on your life.

2. Unlicensed Apps Are Helpless: Loan apps resorting to defamation aren't legitimate. They can't legally harm you. Their only tool is to shame you.

3 Your Contacts Can't Save You: Most of your contacts won't be able to assist you, and they're likely aware of the shady tactics loan sharks use.

4 Beware of Short-Term Loans: Loans with short durations and high interest rates often lead to threats and defamation. Avoid loan sharks. If you must borrow, choose licensed lenders.

5 Debt Leads to Bankruptcy: Borrowing from these apps can wreck your finances and push you towards bankruptcy. The best solution is to stop borrowing altogether.

6 Avoid Overdue Interest: If you've already paid back the principal and initial interest, ignore any demands for overdue interest.

7 Don't Cycle Debts: Taking a loan to pay off another leads to a cycle of debt. Loan sharks have multiple apps, and you'll end up deeper in trouble

8 Use Truecaller to Block: Install Truecaller on your phone to identify loan shark calls and block them. Also, report them on WhatsApp and Google Play Store.

9 Break Free from Loan Sharks: The only way to escape loan sharks is to stop borrowing from them. You survived before they came into your life. Don't let them tarnish your reputation.

10 Stay strong, and prioritize your financial well-being: Remember, health is wealth. Do not allow loan sharks to jeopardize your future!.

-

Alend

First off, you'll be relieved to know that Alend doesn't engage in defamation tactics. Unlike some other loan apps out there, they won't resort to sending derogatory messages to your contacts or tarnishing your reputation.

However, it's essential to understand that Alend takes repayment seriously. If you fail to meet your repayment obligations, they won't hesitate to report you to the appropriate authorities. So, it's crucial to honor your commitments and repay your loans on time to avoid any legal consequences.

When it comes to interest rates, Alend is relatively reasonable. Their overdue interest rates are fair, but here's the catch: once you've paid off the capital and initial interest rate, you have the option to forego paying any further overdue interest. This flexibility can be a lifesaver if you find yourself in a tight spot financially.

Now, let's talk about borrowing responsibly. A golden rule to remember is never to borrow from another loan app to repay your debt to Alend. This will only exacerbate your financial woes and could lead to a vicious cycle of debt. Instead, prioritize paying off your loans when you have the means to do so. If necessary, you can spread out your payments over several months, but make sure you stick to your repayment plan.

To help you manage incoming calls and avoid unwanted contact from Alend, consider installing Truecaller on your mobile phone. This handy app lets you identify callers and block numbers, giving you more control over who can reach you.

In summary, while borrowing from Alendcan be a convenient way to meet your financial needs, it's essential to do so responsibly. By honoring your repayment commitments, avoiding borrowing from other loan apps, and staying vigilant with Truecaller, you can navigate your borrowing experience with confidence.

Remember, financial responsibility is key to maintaining a healthy financial future.

-

AidaCredit

Loan apps offer quick and convenient access to credit, often with minimal documentation and fast approval. However, they can be notorious for high-interest rates, hidden fees, and predatory lending practices.

How to Avoid Loan Apps

- Build an emergency fund: Save 3-6 months' worth of expenses to avoid needing quick loans.

- Create a budget: Track expenses, prioritize needs over wants, and allocate funds wisely.

- Explore alternative credit sources: Consider banks, credit unions, or peer-to-peer lending platforms with more favorable terms.

- Improve credit score: A good credit score can help you qualify for lower-interest loans.

- Avoid unnecessary expenses: Cut back on discretionary spending to reduce the need for loans.

Precautions When Using Loan Apps

- Read terms and conditions: Understand interest rates, fees, repayment terms, and penalties.

- Check lender legitimacy: Research the lender's reputation, licenses, and regulatory compliance.

- Borrow only what you need: Avoid taking more than necessary to minimize debt.

- Set realistic repayment expectations: Plan to repay on time to avoid penalties and interest.

- Monitor your credit report: Ensure loan app activities are accurately reflected.

How to Pay Loan Apps

- Prioritize repayment: Pay on time to avoid penalties and interest.

- Create a repayment plan: Break down debt into manageable installments.

- Use automatic payments: Set up automatic transfers to ensure timely payments.

- Consider debt consolidation: Merge multiple debts into a single, lower-interest loan.

- Communicate with lenders: Inform them of financial difficulties to negotiate payment extensions or reductions.

What to Do in a Financial Crisis

- Seek professional help: Consult a financial advisor or credit counselor.

- Prioritize essential expenses: Focus on necessities like food, rent, and utilities.

- Negotiate with creditors: Discuss payment extensions or reductions.

- Explore government assistance: Look into programs like unemployment benefits or financial aid.

- Consider debt restructuring: Work with a credit counselor to reorganize debt.

Red Flags to Watch Out For

- Exorbitant interest rates: Rates above 36% APR are considered predatory.

- Hidden fees: Look out for origination fees, late fees, or prepayment penalties.

- Unclear repayment terms: Ensure you understand repayment schedules and amounts.

- Lack of transparency: Be wary of lenders with unclear or misleading information.

- Aggressive marketing: Be cautious of lenders with pushy or deceptive marketing tactics.

Additional Tips

- Regulatory bodies: Familiarize yourself with local regulatory agencies, such as the Central Bank of Nigeria, to report suspicious lenders.

- Loan app reviews: Research reviews from multiple sources to gauge lender reputation.

- Financial education: Continuously learn about personal finance and responsible borrowing.

By being informed and cautious, you can navigate loan apps wisely and make better financial decisions

-

Kkcashvip

We will review the apps within the next 48 hours and provide detailed information and also do our background checks10 Commandments for Dealing with Loan Sharks

1. Ignore Harassing Messages: If loan sharks have already contacted your friends or family, don't worry. You don't owe them anything more. Move forward and focus on your life.

2. Unlicensed Apps Are Helpless: Loan apps resorting to defamation aren't legitimate. They can't legally harm you. Their only tool is to shame you.

3 Your Contacts Can't Save You: Most of your contacts won't be able to assist you, and they're likely aware of the shady tactics loan sharks use.

4 Beware of Short-Term Loans: Loans with short durations and high interest rates often lead to threats and defamation. Avoid loan sharks. If you must borrow, choose licensed lenders.

5 Debt Leads to Bankruptcy: Borrowing from these apps can wreck your finances and push you towards bankruptcy. The best solution is to stop borrowing altogether.

6 Avoid Overdue Interest: If you've already paid back the principal and initial interest, ignore any demands for overdue interest.

7 Don't Cycle Debts: Taking a loan to pay off another leads to a cycle of debt. Loan sharks have multiple apps, and you'll end up deeper in trouble

8 Use Truecaller to Block: Install Truecaller on your phone to identify loan shark calls and block them. Also, report them on WhatsApp and Google Play Store.

9 Break Free from Loan Sharks: The only way to escape loan sharks is to stop borrowing from them. You survived before they came into your life. Don't let them tarnish your reputation.

10 Stay strong, and prioritize your financial well-being: Remember, health is wealth. Do not allow loan sharks to jeopardize your future!.

-

Tloan

Tloan, These guys might seem like a quick fix, but trust me, they can turn into a major headache. Here's the lowdown on why you should steer clear:

1. Shameful Tactics: Forget polite reminders. These apps blast your contacts, painting you as a defaulter even after a day's delay. They might even spam your WhatsApp with nasty messages, tarnishing your reputation in a heartbeat.

2. Crushing Deadlines: They offer loans with super-short repayment periods, like 6-14 days. It's like setting you up to fail, leading to...

3. Debt Spiral: Their insane interest rates (think 2% to 7% per DAY!) trap you in a cycle of debt. Borrowing from another app to pay them off? Bad idea. You'll just end up deeper in their clutches.

4. Empty Threats: Don't let their bullying tactics scare you. These apps often operate outside the law, so their threats are mostly just noise. They can't really do anything to you, except try to shame you.

5. Breaking Free: Here's the key: stop borrowing. It's tough, but it's the only way to escape their grip. Remember, you survived before they came along. You can do it again.

Here's your action plan:

- Install Truecaller: Identify and block their calls.

- Block them on WhatsApp: Cut off communication.

- Report them: Flag them on WhatsApp and the app store.

- Seek help: Talk to trusted friends or family, or consider professional financial advice.

Remember, your dignity and peace of mind are worth more than any quick loan. Don't let these loan sharks drag you down. Take back control and build a brighter future, one step at a time.

-

Quickash

We will review the apps within the next 48 hours and provide detailed information and also do our background checks10 Commandments for Dealing with Loan Sharks

1. Ignore Harassing Messages: If loan sharks have already contacted your friends or family, don't worry. You don't owe them anything more. Move forward and focus on your life.

2. Unlicensed Apps Are Helpless: Loan apps resorting to defamation aren't legitimate. They can't legally harm you. Their only tool is to shame you.

3 Your Contacts Can't Save You: Most of your contacts won't be able to assist you, and they're likely aware of the shady tactics loan sharks use.

4 Beware of Short-Term Loans: Loans with short durations and high interest rates often lead to threats and defamation. Avoid loan sharks. If you must borrow, choose licensed lenders.

5 Debt Leads to Bankruptcy: Borrowing from these apps can wreck your finances and push you towards bankruptcy. The best solution is to stop borrowing altogether.

6 Avoid Overdue Interest: If you've already paid back the principal and initial interest, ignore any demands for overdue interest.

7 Don't Cycle Debts: Taking a loan to pay off another leads to a cycle of debt. Loan sharks have multiple apps, and you'll end up deeper in trouble

8 Use Truecaller to Block: Install Truecaller on your phone to identify loan shark calls and block them. Also, report them on WhatsApp and Google Play Store.

9 Break Free from Loan Sharks: The only way to escape loan sharks is to stop borrowing from them. You survived before they came into your life. Don't let them tarnish your reputation.

10 Stay strong, and prioritize your financial well-being: Remember, health is wealth. Do not allow loan sharks to jeopardize your future!.

Step by step guide to break free from loan apps

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.