Expert Review

-

Carbon

Carbon is a trustworthy loan app authorized by the Nigeria government. They respect your privacy and won't call your contacts or guarantors. However, it's important to settle overdue payments promptly. Carbon is like a bank and can report unpaid debts to credit agencies, which might hurt your credit score. This could make it hard to get loans from other places, like banks, in Nigeria. It may take up to 6 months to rebuild your credit score, even after you pay off your debt.

If you owe money to Carbon, try to pay it back gradually. You can split your payments over a few months, like paying ₦1,000 each month, based on what you owe. Don't rush to pay it all at once to avoid stress.

Always pay back Carbon your loans. Don't borrow from other loan apps to pay them back, as this could make your financial situation worse.

-

Flexi Cash

Here's what you should know:

1. They won't hesitate to send SMS to your contacts, letting them know you owe them some cash.

2. Brace yourself for a flood of not-so-nice messages on WhatsApp if you're just a day overdue.

3. Their repayment plans usually span from 6 to 14 days, which can be pretty tough to manage.

4. Watch out for their steep overdue interest rates, ranging from 1% to a hefty 5% per day. That'll just land you in deeper debt.

5. Don't give in and pay up if they start smearing your name. Remember, they've got their cash when they've defamed you.

6. Despite being unlicensed, their go-to move is to defame you. Pretty low, right?

7. Whatever you do, don't try borrowing from another loan app to settle your debts with them. It's a recipe for financial disaster.

8. Consider installing Truecaller on your phone to screen their calls and block them altogether.

9. The best way to shake off these loan sharks? Stop borrowing altogether.

10. If they're causing trouble, don't hesitate to block them on WhatsApp and report their shady practices straight to WhatsApp and the Google Play Store.

11. Remember, you were doing just fine before they showed up. Don't let them tarnish your reputation or your wallet.

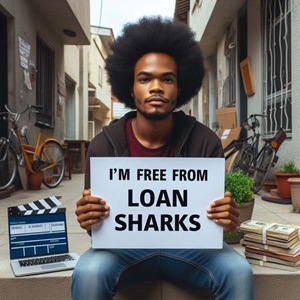

Step by step guide to break free from loan apps

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.