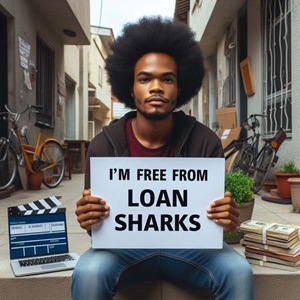

Expert Review

-

Ease moni

We will review the apps within the next 48 hours and provide detailed information and also do our background checks10 Commandments for Dealing with Loan Sharks

1. Ignore Harassing Messages: If loan sharks have already contacted your friends or family, don't worry. You don't owe them anything more. Move forward and focus on your life.

2. Unlicensed Apps Are Helpless: Loan apps resorting to defamation aren't legitimate. They can't legally harm you. Their only tool is to shame you.

3 Your Contacts Can't Save You: Most of your contacts won't be able to assist you, and they're likely aware of the shady tactics loan sharks use.

4 Beware of Short-Term Loans: Loans with short durations and high interest rates often lead to threats and defamation. Avoid loan sharks. If you must borrow, choose licensed lenders.

5 Debt Leads to Bankruptcy: Borrowing from these apps can wreck your finances and push you towards bankruptcy. The best solution is to stop borrowing altogether.

6 Avoid Overdue Interest: If you've already paid back the principal and initial interest, ignore any demands for overdue interest.

7 Don't Cycle Debts: Taking a loan to pay off another leads to a cycle of debt. Loan sharks have multiple apps, and you'll end up deeper in trouble

8 Use Truecaller to Block: Install Truecaller on your phone to identify loan shark calls and block them. Also, report them on WhatsApp and Google Play Store.

9 Break Free from Loan Sharks: The only way to escape loan sharks is to stop borrowing from them. You survived before they came into your life. Don't let them tarnish your reputation.

10 Stay strong, and prioritize your financial well-being: Remember, health is wealth. Do not allow loan sharks to jeopardize your future!.

-

CashRun

Important Information for CashRun Users:

Downloaded the App Outside the Play Store?

If you downloaded the CashRun app from any platform other than the Play Store, you might have given the app access to your contacts by granting permission. In this case, you should consider generating your own disclaimer to protect your privacy. For assistance, visit: Generate Your Own Disclaimer.Beware of Loan Agents Scamming on Social Media

Loan agents may attempt to scam you in groups or on social media. Before falling victim, read about the latest tactics they are using to deceive people on platforms like Facebook: Read How Loan Agents Are Scamming.Can Contacts Be Cleared from Loan App Databases?

No one can completely erase your contacts from loan app databases. Learn more about the reality of clearing your contacts here: Clearing Contacts from Loan Apps.Ignore Harassing Messages

If loan agents have already contacted your friends or family, don't stress. You don't owe them anything beyond what’s legally required. Focus on moving forward with your life.Unlicensed Loan Apps Have No Real Power

Loan apps resorting to harassment or defamation are often unlicensed and lack any legitimate legal authority. Their only weapon is public shaming, which they cannot enforce legally.Your Contacts Can't Save You

Even if they contact your friends or family, most people won’t be able to help, and many are already familiar with the manipulative tactics used by loan sharks.Avoid Short-Term Loans with High Interest

Loans with extremely short repayment periods (such as 7 days) and high interest rates often result in threats or defamation. Stick to licensed lenders if borrowing is absolutely necessary.Debt Can Lead to Bankruptcy

Unregulated loans from such apps can spiral out of control, pushing you towards financial ruin. The best strategy is to stop borrowing from these sources altogether.Avoid Overdue Interest

If you've already repaid the principal and agreed-upon interest, ignore demands for any overdue interest. Stay focused on paying what’s fair.Don’t Get Caught in a Debt Cycle

Taking one loan to pay off another creates a dangerous cycle. Many loan sharks operate across multiple apps, leading borrowers deeper into financial trouble.Block Loan Sharks with Truecaller

Install Truecaller to easily identify and block calls from loan sharks. You can also report them via WhatsApp or the Google Play Store.Break Free from Loan Sharks

The best way to escape the cycle of loan sharks is to stop borrowing from them entirely. Remember, you lived without them before—they don’t define your life or reputation.Prioritize Your Financial Well-being

Stay strong, and don’t let loan sharks jeopardize your future. Remember, your health and financial well-being are far more important than any short-term loan.Stay informed and make choices that protect your financial future!

-

Okash

- Okash is a legit and authorized loan app, so you're in safe hands.

- They won't tarnish your reputation or spread rumors about you.

- If you default on your payments, they'll take the necessary steps and report the matter to the appropriate authorities.

- While their overdue interest rates are fair, you have the option to skip paying them back once you've settled the principal and initial interest.

- Avoid borrowing from other loan apps to settle your debt with Okash. Instead, pay them back when you have the funds available. You can even stretch out your payments over several months, just make sure to honor your commitment.

- Consider installing Truecaller on your phone to identify and block their calls if you'd rather not engage with them.

-

Alend

First off, you'll be relieved to know that Alend doesn't engage in defamation tactics. Unlike some other loan apps out there, they won't resort to sending derogatory messages to your contacts or tarnishing your reputation.

However, it's essential to understand that Alend takes repayment seriously. If you fail to meet your repayment obligations, they won't hesitate to report you to the appropriate authorities. So, it's crucial to honor your commitments and repay your loans on time to avoid any legal consequences.

When it comes to interest rates, Alend is relatively reasonable. Their overdue interest rates are fair, but here's the catch: once you've paid off the capital and initial interest rate, you have the option to forego paying any further overdue interest. This flexibility can be a lifesaver if you find yourself in a tight spot financially.

Now, let's talk about borrowing responsibly. A golden rule to remember is never to borrow from another loan app to repay your debt to Alend. This will only exacerbate your financial woes and could lead to a vicious cycle of debt. Instead, prioritize paying off your loans when you have the means to do so. If necessary, you can spread out your payments over several months, but make sure you stick to your repayment plan.

To help you manage incoming calls and avoid unwanted contact from Alend, consider installing Truecaller on your mobile phone. This handy app lets you identify callers and block numbers, giving you more control over who can reach you.

In summary, while borrowing from Alendcan be a convenient way to meet your financial needs, it's essential to do so responsibly. By honoring your repayment commitments, avoiding borrowing from other loan apps, and staying vigilant with Truecaller, you can navigate your borrowing experience with confidence.

Remember, financial responsibility is key to maintaining a healthy financial future.

-

AidaCredit

Loan apps offer quick and convenient access to credit, often with minimal documentation and fast approval. However, they can be notorious for high-interest rates, hidden fees, and predatory lending practices.

How to Avoid Loan Apps

- Build an emergency fund: Save 3-6 months' worth of expenses to avoid needing quick loans.

- Create a budget: Track expenses, prioritize needs over wants, and allocate funds wisely.

- Explore alternative credit sources: Consider banks, credit unions, or peer-to-peer lending platforms with more favorable terms.

- Improve credit score: A good credit score can help you qualify for lower-interest loans.

- Avoid unnecessary expenses: Cut back on discretionary spending to reduce the need for loans.

Precautions When Using Loan Apps

- Read terms and conditions: Understand interest rates, fees, repayment terms, and penalties.

- Check lender legitimacy: Research the lender's reputation, licenses, and regulatory compliance.

- Borrow only what you need: Avoid taking more than necessary to minimize debt.

- Set realistic repayment expectations: Plan to repay on time to avoid penalties and interest.

- Monitor your credit report: Ensure loan app activities are accurately reflected.

How to Pay Loan Apps

- Prioritize repayment: Pay on time to avoid penalties and interest.

- Create a repayment plan: Break down debt into manageable installments.

- Use automatic payments: Set up automatic transfers to ensure timely payments.

- Consider debt consolidation: Merge multiple debts into a single, lower-interest loan.

- Communicate with lenders: Inform them of financial difficulties to negotiate payment extensions or reductions.

What to Do in a Financial Crisis

- Seek professional help: Consult a financial advisor or credit counselor.

- Prioritize essential expenses: Focus on necessities like food, rent, and utilities.

- Negotiate with creditors: Discuss payment extensions or reductions.

- Explore government assistance: Look into programs like unemployment benefits or financial aid.

- Consider debt restructuring: Work with a credit counselor to reorganize debt.

Red Flags to Watch Out For

- Exorbitant interest rates: Rates above 36% APR are considered predatory.

- Hidden fees: Look out for origination fees, late fees, or prepayment penalties.

- Unclear repayment terms: Ensure you understand repayment schedules and amounts.

- Lack of transparency: Be wary of lenders with unclear or misleading information.

- Aggressive marketing: Be cautious of lenders with pushy or deceptive marketing tactics.

Additional Tips

- Regulatory bodies: Familiarize yourself with local regulatory agencies, such as the Central Bank of Nigeria, to report suspicious lenders.

- Loan app reviews: Research reviews from multiple sources to gauge lender reputation.

- Financial education: Continuously learn about personal finance and responsible borrowing.

By being informed and cautious, you can navigate loan apps wisely and make better financial decisions

-

Urgent money

We will review the apps within the next 48 hours and provide detailed information and also do our background checks10 Commandments for Dealing with Loan Sharks

1. Ignore Harassing Messages: If loan sharks have already contacted your friends or family, don't worry. You don't owe them anything more. Move forward and focus on your life.

2. Unlicensed Apps Are Helpless: Loan apps resorting to defamation aren't legitimate. They can't legally harm you. Their only tool is to shame you.

3 Your Contacts Can't Save You: Most of your contacts won't be able to assist you, and they're likely aware of the shady tactics loan sharks use.

4 Beware of Short-Term Loans: Loans with short durations and high interest rates often lead to threats and defamation. Avoid loan sharks. If you must borrow, choose licensed lenders.

5 Debt Leads to Bankruptcy: Borrowing from these apps can wreck your finances and push you towards bankruptcy. The best solution is to stop borrowing altogether.

6 Avoid Overdue Interest: If you've already paid back the principal and initial interest, ignore any demands for overdue interest.

7 Don't Cycle Debts: Taking a loan to pay off another leads to a cycle of debt. Loan sharks have multiple apps, and you'll end up deeper in trouble

8 Use Truecaller to Block: Install Truecaller on your phone to identify loan shark calls and block them. Also, report them on WhatsApp and Google Play Store.

9 Break Free from Loan Sharks: The only way to escape loan sharks is to stop borrowing from them. You survived before they came into your life. Don't let them tarnish your reputation.

10 Stay strong, and prioritize your financial well-being: Remember, health is wealth. Do not allow loan sharks to jeopardize your future!.

-

L Credit

Allow me to shed some light on LCredit and what you need to know to safeguard your financial well-being.

To begin with, LCredit has a rather aggressive approach when it comes to debt collection. They won't hesitate to bombard every single one of your contacts with automated calls, making sure everyone knows about your outstanding debt. And if that's not enough, they'll also flood your WhatsApp with derogatory messages if you're just one day overdue. It's not a pleasant experience, to say the least.

Now, let's talk about their repayment plans. LCredit typically offers repayment periods ranging from 6 days to 14 days, which can be quite challenging to meet. And to make matters worse, their overdue interest rates can soar as high as 5% to 7% per day, pushing you further into the abyss of debt.

Here's a crucial piece of advice: once LCredit starts defaming you, don't even think about paying them back. They've already gotten what they wanted, and paying them won't make the derogatory messages disappear. Plus, since they're not licensed, they don't have much legal recourse besides tarnishing your reputation.

Whatever you do, resist the temptation to borrow from another loan app to repay LCredit. They have a plethora of apps scattered across mobile app stores, so if you think you're escaping one debt by borrowing from another, think again. You'll only find yourself sinking deeper into financial trouble.

To shield yourself from LCredit's relentless harassment, consider installing Truecaller on your mobile phone. This handy app can help you identify and block their calls, giving you some much-needed peace of mind.

Ultimately, the best way to break free from LCredit's clutches is to stop borrowing altogether. It might not be easy, but it's the only way to avoid getting caught in their web of debt.

Take care, and remember that your financial well-being is worth more than any loan. Stay vigilant, make wise borrowing decisions, and don't let LCredit or any other loan shark drag you down.

-

APEX

Prepare for an onslaught of SMS messages sent to your contacts, claiming you owe money.

Be prepared for a flood of aggressive WhatsApp messages if you're even a day late.

Their repayment periods usually range from 6 to 14 days, making it extremely difficult to settle the debt.

Expect exorbitant daily interest rates of 5% to 7%, pushing you further into financial trouble.

Once they tarnish your reputation, there's no point in repaying them. They've achieved their goal.

Since they lack proper licensing, they cannot pursue legal action against you. Their only recourse is to damage your reputation.

Avoid borrowing from other loan apps to repay these debts; it will only exacerbate the situation.

Utilize Truecaller to filter and block their calls, sparing yourself unnecessary stress.

The most effective way to escape loan sharks is to refrain from borrowing altogether.

Block them on WhatsApp and file reports directly with WhatsApp and the Google Play Store to prevent others from falling victim to the same scheme.

Step by step guide to break free from loan apps

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.