Expert Review

-

Cash9ja

Cash9ja is a dynamic loan application designed to cater to the financial needs of Nigerians. Developed by Samued Tech Nigeria Limited, this platform is dedicated to providing quick and convenient cash loans, ensuring user satisfaction every step of the way.

Company Overview

- Full Legal Corporate Name: Samued Tech Nigeria Limited

- Approved App by FCCPC: Cash9ja

- Approval No.: FCCPC/DSE/INV/ML/451

As a registered digital money lender in Nigeria, Samued Tech Nigeria Limited operates in compliance with all relevant policies and regulations. The company's commitment to adhering to regulatory standards ensures that your loan experience is both safe and reliable.

Embrace Financial Freedom with Cash9ja

Cash9ja is committed to fostering diversity and innovation in the financial sector. The app allows users to access the funds they need quickly, empowering them to tackle various personal and business challenges. Whether it's for bill payments, medical expenses, rent, or other urgent needs, Cash9ja provides a digital service designed to meet your requirements.

With Cash9ja, you can enjoy a seamless application process and receive the necessary funds almost instantly. Why wait? Start your application now and experience the convenience of immediate cash access!

Conditions for Cash9ja Loan Application

Applying for a cash loan through Cash9ja is a straightforward process. Here’s how you can secure your loan in just a few steps:

- Use Your Smartphone: Ensure you have a smartphone to access the Cash9ja app.

- Download the App: Go to the Google Play Store, download the Cash9ja app, and install it.

- Fill Out the Form: Complete the application form, which should take no more than 5 minutes.

- Get the Loan Credit: Submit your application and await a credit decision.

- Approval Notification: Wait for approval regarding your online loan application.

- Receive Funds: Get loan amounts ranging from ₦6,000 to ₦200,000 deposited directly into your bank account.

Advantages of Cash9ja

- Unsecured Loans: Cash9ja offers loans without requiring collateral, making it accessible to more users.

- No Office Visits Required: You can apply for loans from the comfort of your home without the need to visit a physical office.

- No Hidden Fees: Enjoy transparency with no hidden charges—what you see is what you get.

- Fast Disbursement: Experience instant disbursement within 5 minutes after approval.

- Increasing Approval Amount: As you build your credit history with Cash9ja, you can access higher loan amounts over time.

Start your journey toward obtaining significant financial support today, with loan amounts ranging from ₦6,000 to ₦200,000.

Eligibility Criteria

To qualify for a loan with Cash9ja, applicants must meet the following requirements:

- Age: Must be a Nigerian citizen aged 18 years or older.

- Bank Account: Applicants must have a valid bank account to receive funds.

- Stable Income: A steady income source is necessary to demonstrate repayment capability.

Loan Information & Examples

- Loan Amount: ₦6,000 to ₦200,000

- Loan Term: 90 to 360 days

- Interest Rate: Daily interest rates range from 0.04% to 0.08%.

- Processing Fee: 1% of the principal amount.

- Maximum Annual Percentage Rate (APR): 33.26%.

Example Calculation

For a 90-day loan with a principal amount of ₦6,000 and a daily interest rate of 0.06%:

- Total Interest Fee: ₦6,000 × 0.06% × 90 days = ₦324

- Processing Fee: ₦6,000 × 1% = ₦60

- Total Repayment Amount: ₦6,000 + ₦324 + ₦60 = ₦6,384

- Repayment Per Period: ₦6,384 / 3 = ₦2,128 (if repaid in 3 periods)

Privacy and Permissions

At Cash9ja, your privacy is of utmost importance. We adhere to strict data protection regulations and ensure that your personal information is securely stored. We will never share your data with third parties without your explicit consent. For more details, please refer to our Privacy Policy.

Customer Support

We are always here to assist you! If you have any questions, concerns, or feedback, please do not hesitate to reach out to us:

- Email: service@samuedltd.com

- Website: Cash9ja Official Website

- Working Hours: 9:00 AM - 6:00 PM (Monday to Saturday)

- Address: 115, Mado Street, Tudun Wada, Plateau State, Nigeria

With Cash9ja, you're not just getting a loan; you're gaining a reliable financial partner ready to support your journey towards financial stability. Start applying today and unlock your potential!

-

Tloan

Tloan, These guys might seem like a quick fix, but trust me, they can turn into a major headache. Here's the lowdown on why you should steer clear:

1. Shameful Tactics: Forget polite reminders. These apps blast your contacts, painting you as a defaulter even after a day's delay. They might even spam your WhatsApp with nasty messages, tarnishing your reputation in a heartbeat.

2. Crushing Deadlines: They offer loans with super-short repayment periods, like 6-14 days. It's like setting you up to fail, leading to...

3. Debt Spiral: Their insane interest rates (think 2% to 7% per DAY!) trap you in a cycle of debt. Borrowing from another app to pay them off? Bad idea. You'll just end up deeper in their clutches.

4. Empty Threats: Don't let their bullying tactics scare you. These apps often operate outside the law, so their threats are mostly just noise. They can't really do anything to you, except try to shame you.

5. Breaking Free: Here's the key: stop borrowing. It's tough, but it's the only way to escape their grip. Remember, you survived before they came along. You can do it again.

Here's your action plan:

- Install Truecaller: Identify and block their calls.

- Block them on WhatsApp: Cut off communication.

- Report them: Flag them on WhatsApp and the app store.

- Seek help: Talk to trusted friends or family, or consider professional financial advice.

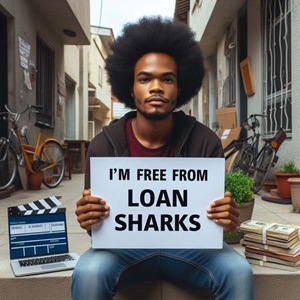

Remember, your dignity and peace of mind are worth more than any quick loan. Don't let these loan sharks drag you down. Take back control and build a brighter future, one step at a time.

-

AIRMONI

Prepare for an onslaught of SMS messages sent to your contacts, claiming you owe money.

Be prepared for a flood of aggressive WhatsApp messages if you're even a day late.

Their repayment periods usually range from 6 to 14 days, making it extremely difficult to settle the debt.

Expect exorbitant daily interest rates of 5% to 7%, pushing you further into financial trouble.

Once they tarnish your reputation, there's no point in repaying them. They've achieved their goal.

Since they lack proper licensing, they cannot pursue legal action against you. Their only recourse is to damage your reputation.

Avoid borrowing from other loan apps to repay these debts; it will only exacerbate the situation.

Utilize Truecaller to filter and block their calls, sparing yourself unnecessary stress.

The most effective way to escape loan sharks is to refrain from borrowing altogether.

Block them on WhatsApp and file reports directly with WhatsApp and the Google Play Store to prevent others from falling victim to the same scheme.

-

Frimoni

Protect Yourself When Dealing with Unregistered Loan Apps: A Guide for Frimoni Users

If you're managing loans from unregulated loan providers like IMoney, it's essential to understand certain key aspects of repayment and how to safeguard yourself. Here’s what you need to know when dealing with such platforms:

1. Unregistered Loan Apps

IMoney is not a registered loan app, meaning it does not adhere to the legal guidelines set by Nigerian financial authorities. This lack of regulation can lead to unethical practices, so proceed with caution if you're involved with such services.

2. Dealing with Derogatory Messages to Your Contacts

If IMoney has sent offensive or embarrassing messages to your contacts in an attempt to pressure you into repayment, do not panic. While this tactic is harmful, it’s a strategy used to coerce borrowers. You are not legally obligated to repay under duress. If they persist, calmly inform them that you’re ready to address the matter in court, which often dissuades further harassment.

3. Defamation and Reputational Harm

If your reputation has already been damaged by IMoney through defamatory messages, repaying them will not necessarily undo the harm caused. Once your reputation is affected, the damage is done, and paying them back may not restore it. Focus on protecting yourself from further harassment instead.

4. Install TrueCaller to Block Spam Calls

Install the TrueCaller app on your phone to help identify and block spam calls, including any harassing calls from IMoney. This app provides an extra layer of protection against unwanted contact.

5. Block Auto Debit from Your Bank Account

To prevent IMoney from automatically withdrawing money from your bank account, it’s essential to block your bank card. Visit your bank and request a new card to ensure they can't access your funds through auto-debit.

6. Block and Report on WhatsApp

If IMoney contacts you via WhatsApp, block their number to stop receiving their messages. Additionally, report their number to WhatsApp to alert the platform about their behavior, which may lead to their account being flagged or suspended.

7. Report the App to Google Play or iOS App Store

If IMoney is listed on the Google Play Store or iOS App Store, report the app to the platform. This not only helps alert other users to their unethical practices but may also result in the removal of the app from these stores, protecting future borrowers.

Take Action to Protect Yourself

By following these steps, you can safeguard yourself from further harassment and protect your finances. Whether it's blocking calls, reporting the app, or preventing unauthorized withdrawals, you have control over how to respond to unethical loan providers like IMoney.

Remember, Frimoni provides a safe and transparent loan process, so you can avoid these pitfalls with our reliable service. Always choose trusted, registered loan apps to protect your peace of mind.

-

Okash

- Okash is a legit and authorized loan app, so you're in safe hands.

- They won't tarnish your reputation or spread rumors about you.

- If you default on your payments, they'll take the necessary steps and report the matter to the appropriate authorities.

- While their overdue interest rates are fair, you have the option to skip paying them back once you've settled the principal and initial interest.

- Avoid borrowing from other loan apps to settle your debt with Okash. Instead, pay them back when you have the funds available. You can even stretch out your payments over several months, just make sure to honor your commitment.

- Consider installing Truecaller on your phone to identify and block their calls if you'd rather not engage with them.

-

Alend

First off, you'll be relieved to know that Alend doesn't engage in defamation tactics. Unlike some other loan apps out there, they won't resort to sending derogatory messages to your contacts or tarnishing your reputation.

However, it's essential to understand that Alend takes repayment seriously. If you fail to meet your repayment obligations, they won't hesitate to report you to the appropriate authorities. So, it's crucial to honor your commitments and repay your loans on time to avoid any legal consequences.

When it comes to interest rates, Alend is relatively reasonable. Their overdue interest rates are fair, but here's the catch: once you've paid off the capital and initial interest rate, you have the option to forego paying any further overdue interest. This flexibility can be a lifesaver if you find yourself in a tight spot financially.

Now, let's talk about borrowing responsibly. A golden rule to remember is never to borrow from another loan app to repay your debt to Alend. This will only exacerbate your financial woes and could lead to a vicious cycle of debt. Instead, prioritize paying off your loans when you have the means to do so. If necessary, you can spread out your payments over several months, but make sure you stick to your repayment plan.

To help you manage incoming calls and avoid unwanted contact from Alend, consider installing Truecaller on your mobile phone. This handy app lets you identify callers and block numbers, giving you more control over who can reach you.

In summary, while borrowing from Alendcan be a convenient way to meet your financial needs, it's essential to do so responsibly. By honoring your repayment commitments, avoiding borrowing from other loan apps, and staying vigilant with Truecaller, you can navigate your borrowing experience with confidence.

Remember, financial responsibility is key to maintaining a healthy financial future.

-

Nicenaira

- They’ll send SMS blasts to your contacts, claiming you owe them money.

- Be ready for a flood of nasty WhatsApp messages if you’re even a day late.

- Their repayment windows are ridiculously short—just 6 to 14 days—making it nearly impossible to repay on time.

- Expect daily overdue interest rates between 5% and 7%, pushing you deeper into debt.

- Once they’ve trashed your reputation, paying them back is pointless—they’ve already hit their goal.

- Since they’re unlicensed, they can’t take legal action. Ruining your name is their only weapon.

- Don’t borrow from other loan apps to clear your debt—it’ll only dig you into a deeper hole.

- Use Truecaller to block their calls and protect your peace of mind.

- The best way to beat loan sharks? Stop borrowing altogether.

- Block them on WhatsApp and report them to both WhatsApp and Google Play Store to stop others from falling into their trap.

-

Palmcredit

Palmcredit is a reputable lending platform that prioritizes borrower satisfaction and provides valuable financial assistance. Here are some essential aspects to consider when engaging with Palmcredit:

After 30 days you'll stop receiving calls and messages from them

Respectful Repayment Approach: Palmcredit upholds a respectful approach towards repayment. They do not engage in defamatory practices if borrowers opt to repay gradually until the full amount is settled. This allows borrowers to manage their repayment schedule at their own pace without facing any negative consequences from the platform.

Interest Payment Guidelines: Borrowers are advised not to pay overdue interest after clearing the normal interest and capital amount. Following this guideline helps borrowers avoid unnecessary financial strain and ensures a smoother repayment process.

Communication Management: In cases where borrowers experience persistent communication from Palmcredit via calls or WhatsApp messages, it is advisable to block their contacts and WhatsApp numbers. This proactive step empowers borrowers to maintain their peace of mind and minimize potential disturbances.

Avoid Borrowing to Repay: It is strongly discouraged to borrow from another loan app to settle dues with Palmcredit. Engaging in such practices may lead to a cycle of debt and financial instability, exacerbating existing financial challenges.

Utilize Truecaller for Blocking: Installing Truecaller on a mobile phone can be beneficial for borrowers looking to block unwanted calls from Palmcredit. Truecaller allows users to identify and block spam calls, including those from lenders, thereby providing an additional layer of control over communication channels.

By adhering to these guidelines and leveraging Palmcredit's transparent and borrower-centric approach, individuals can effectively manage their financial obligations and maintain a positive relationship with the platform.

-

CranCash

dodgy loan apps. Let's call them what they are - loan sharks hiding behind fancy apps. These guys play dirty, and you need to know how to dodge their traps.

Here's the lowdown:

1. Shame Game: These loan sharks don't just come after you, they go after your loved ones too! They might blast your contacts with messages saying you owe them money, trying to embarrass you into paying. Nasty, right?

2. Debt Trap: Forget fair repayment plans. They offer short deadlines (like 6-14 days!), impossible to meet, then hit you with sky-high daily interest (2-7%!). This just digs you deeper into debt.

3. Don't Feed the Beast: If they start shaming you, don't cave in and pay. Remember, they already got their money by damaging your reputation. Don't let them win twice!

4. Empty Threats: These apps operate illegally, so they have no real power over you. Their only weapon is public shaming. Don't be scared!

5. Double Trouble: Avoid the temptation to borrow from another loan app to pay them off. It's a slippery slope leading to a debt avalanche. Trust me, they have many apps hiding, so you might end up paying them anyway.

6. Information is Power: Fight back! Install Truecaller to identify their calls and block their numbers. Report them directly to WhatsApp and Google Play Store. Make some noise!

7. Break Free: The real key to escaping these loan sharks is simple: STOP BORROWING! You survived before them, you'll survive without them. Don't let them control your life or damage your self-respect.

8. Silence the Noise: Block them on WhatsApp and report them. Remember, they thrive on fear. Don't give them that power!

9. You Got This: You can break free from these loan sharks. Just stop borrowing and focus on finding other ways to get by. They may be loud, but you are stronger. Don't let them win!

Remember, your integrity is priceless. Don't let these loan sharks mess with it. Be smart, be informed, and most importantly, be free!

-

Palmpay

When considering loans from PalmPay, it’s crucial to be aware of the following practices:

1. Broadcasting Your Debt

PalmPay may not hesitate to inform your contacts via SMS about your outstanding debt. This tactic is aimed at putting pressure on you to repay quickly.

2. Harassment on WhatsApp

If you're even a day late on repayment, you can expect to receive a barrage of aggressive messages through WhatsApp. This can be overwhelming and adds stress to an already difficult situation.

3. Tight Repayment Window

PalmPay typically has short repayment periods ranging from 6 to 14 days, making it challenging to meet deadlines and manage your finances effectively.

4. High Interest on Overdue Payments

Overdue payments can incur high interest rates that escalate quickly, ranging from 1% to 5% per day. This can lead to a rapid accumulation of debt, making it difficult to regain control of your financial situation.

5. Reputation Over Debt

Once PalmPay starts defaming you, simply repaying the debt may not restore your reputation. Their actions can tarnish your name long after the debt is settled.

6. Unlicensed and Defamatory Tactics

Even if PalmPay operates without proper licensing, their primary strategy often relies on defamation—a cheap and unethical way to compel repayment.

7. Avoid Borrowing from Other Loan Apps

Refrain from borrowing from other loan apps to repay PalmPay. This can trap you in a vicious cycle of debt that becomes increasingly difficult to escape.

8. Block Their Calls

Utilize apps like Truecaller to identify and block persistent calls from PalmPay. This can help reduce stress and interruptions in your daily life.

9. Break Free

The most effective solution is to stop borrowing from PalmPay entirely. Free yourself from their cycle of debt and regain control over your finances.

10. Take Action

If PalmPay engages in unscrupulous behavior, don’t hesitate to block them on WhatsApp and report their actions to WhatsApp and the Google Play Store.

11. Stay in Control

Remember, you were managing your finances just fine before PalmPay entered the picture. Don't let their tactics damage your reputation or drain your finances. Take charge of your financial future today!

Step by step guide to break free from loan apps

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.