Expert Review

-

Xcrosscash

Xcrosscash is a lending platform that offers financial assistance to individuals in need. Here are some important points to know about their services:

1. Respectful Repayment Process: Xcrosscash does not engage in defamatory practices if borrowers pay their dues gradually until the full repayment is completed. This means that borrowers can manage their repayment schedule at their own pace without facing any negative repercussions from the platform.

2. Interest Payment Guidelines: It is advisable not to pay overdue interest after settling the normal interest and capital amount. By adhering to this guideline, you can avoid unnecessary financial burden and ensure a smoother repayment process.

3. Communication Management: In case you experience persistent communication from Xcrosscash via calls or WhatsApp messages, it is recommended to block their contacts and WhatsApp numbers. This step can help you maintain their peace of mind and avoid unnecessary disturbances.

4. Avoid Borrowing to Repay: You should refrain from borrowing from another loan app to repay their dues to Xcrosscash. Doing so can lead to a cycle of debt and financial instability, which may exacerbate the existing financial challenges.

5. Utilize Truecaller for Blocking: Installing Truecaller on a mobile phone can be beneficial for you who wish to block unwanted calls from Xcrosscash. This app allows users to identify and block spam calls, including those from lenders, thus providing added control over communication channels.

By understanding and adhering to these guidelines, you can effectively manage their repayment journey with Xcrosscash and maintain a positive financial standing.

-

Easybuy

It's an app that gives you quick cash, but hold on – things work a little differently here. Let's break it down, no confusing terms:

1. Legit Loaners: Unlike some shady apps, Easybuy is registered and approved, meaning they play by the rules. That's good news!

2. Phone Fix or Phone Freeze: Need a new phone? Easybuy can help. But remember, pay on time or your phone goes bye-bye! No nasty texts, just a frozen phone until you settle up.

3. Clean Reputation: Unlike those other guys, Easybuy won't embarrass you publicly. They wouldn't dream of it!

4. Authority Figure Alert: If you skip payments for too long, they might involve the authorities to help resolve things. Remember, responsible borrowing is key!

5. Fair Interest, Your Choice: Their interest rates aren't crazy high, but they do add up if you're late. Here's the twist: once you pay back the اصلی amount and the initial interest, you can choose not to pay the overdue charges. Sounds fair, right?

6. Debt Trap Dodge: Don't get caught in the "borrow to pay" cycle! Only borrow from Easybuy when you have a plan to repay on time. Remember, even small payments spread over months add up, so be responsible.

7. Caller ID Power: Want to screen their calls? Download Truecaller! It helps you identify who's calling, so you can decide to pick up or not. No pressure!

Remember: Easybuy is different. They're legit, but not your personal piggy bank. Borrow smart, pay on time, and you'll be golden. But if you mess around, well, let's just say your phone won't be the only thing on hold.

The choice is yours, my friend. Choose wisely!

-

Palmcredit

Palmcredit is a reputable lending platform that prioritizes borrower satisfaction and provides valuable financial assistance. Here are some essential aspects to consider when engaging with Palmcredit:

After 30 days you'll stop receiving calls and messages from them

Respectful Repayment Approach: Palmcredit upholds a respectful approach towards repayment. They do not engage in defamatory practices if borrowers opt to repay gradually until the full amount is settled. This allows borrowers to manage their repayment schedule at their own pace without facing any negative consequences from the platform.

Interest Payment Guidelines: Borrowers are advised not to pay overdue interest after clearing the normal interest and capital amount. Following this guideline helps borrowers avoid unnecessary financial strain and ensures a smoother repayment process.

Communication Management: In cases where borrowers experience persistent communication from Palmcredit via calls or WhatsApp messages, it is advisable to block their contacts and WhatsApp numbers. This proactive step empowers borrowers to maintain their peace of mind and minimize potential disturbances.

Avoid Borrowing to Repay: It is strongly discouraged to borrow from another loan app to settle dues with Palmcredit. Engaging in such practices may lead to a cycle of debt and financial instability, exacerbating existing financial challenges.

Utilize Truecaller for Blocking: Installing Truecaller on a mobile phone can be beneficial for borrowers looking to block unwanted calls from Palmcredit. Truecaller allows users to identify and block spam calls, including those from lenders, thereby providing an additional layer of control over communication channels.

By adhering to these guidelines and leveraging Palmcredit's transparent and borrower-centric approach, individuals can effectively manage their financial obligations and maintain a positive relationship with the platform.

-

FairMoney

Let's talk about FairMoney and what you need to know to navigate your borrowing journey smoothly.

First off, FairMoney is different from your typical loan app. They won't resort to defaming you or harassing your contacts if you fall behind on payments. Instead, they take a more professional approach and report any delinquent accounts to the appropriate authorities. It's a more respectful way of handling things, don't you think?

Now, when it comes to overdue interest, FairMoney is pretty fair (hence the name). Their rates are reasonable, and if you've paid off the capital and initial interest, you can decide not to pay the overdue interest. It's a nice little perk that gives you some flexibility in managing your finances.

Here's a golden rule: never borrow from another loan app to repay FairMoney. It's a slippery slope that can lead to even more debt. Instead, only borrow what you need when you have the money, and make sure to spread out your payments over several months. That way, you can stay on top of your finances without feeling overwhelmed.

To help you avoid any unwanted calls from FairMoney, consider installing Truecaller on your phone. This handy app can identify incoming calls and allow you to block them if you prefer not to answer. It's a simple but effective way to maintain some peace and quiet.

So, there you have it. FairMoney is a reliable option for borrowing money when you need it most. Just remember to borrow responsibly, stay on top of your payments, and you'll be well on your way to financial freedom.

Take care, and happy borrowing!

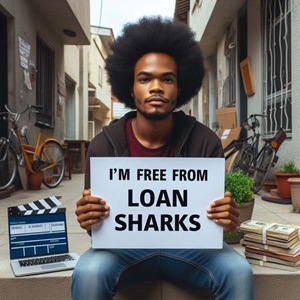

Step by step guide to break free from loan apps

What you should know

-

Any loan sharks that defame are never linked to the credit bureau in anyway and all they say to you are lies.

-

Loan shark money cannot help solve anybody matter to better 40% - 70% in 7 days, they are simply misery compounders!! Do away with them.

-

Loan Apps major aim is to make outrageous profit from people and render people bankrupt. Dont be a victim

What people are saying

Add a review

Your comment could save a life! Share your experience with loan apps and help others escape the clutches of Loan Shark Apps.